Tax-Smart Moves I Made Before Retirement – You’ll Want These Tips

Retirement planning isn’t just about how much you save—it’s also about how much you keep. I learned this the hard way when a surprise tax bill hit me early in retirement. Since then, I’ve restructured my approach, focusing on tax compliance and smarter withdrawals. What seemed like small changes made a huge difference. In this article, I’ll walk you through the real-life strategies that helped me reduce tax stress and protect my income. These are not theoretical concepts—they’re practical, tested moves that anyone can apply to build a more secure and tax-efficient retirement.

The Wake-Up Call: How a Tax Surprise Changed My Retirement Plan

When I first retired, I felt confident. I had saved consistently for over 35 years, diversified my portfolio, and believed I had more than enough to maintain my lifestyle. I even consulted a financial advisor before stepping away from full-time work. But no one fully explained how taxes would reshape my retirement reality. The first major shock came with my Required Minimum Distribution (RMD) from my traditional IRA. I assumed that since the money had been growing tax-deferred, withdrawing it would be a simple matter of paying ordinary income tax. What I didn’t anticipate was how that single withdrawal could push me into a higher tax bracket—especially when combined with my Social Security benefits and pension income.

The issue stemmed from a misunderstanding of how retirement accounts are taxed. Traditional IRAs and 401(k)s allow contributions with pre-tax dollars, meaning you don’t pay taxes upfront. But when you withdraw funds in retirement, every dollar is taxed as ordinary income. That includes both your contributions and the compounded growth. In my case, the RMD amount, though necessary, significantly increased my adjusted gross income (AGI). This higher AGI not only raised my federal tax rate but also triggered additional taxation on my Social Security benefits—something I hadn’t factored into my planning. Up to 85% of Social Security income can become taxable depending on your combined income, and I crossed that threshold unintentionally.

Looking back, I realize that a more balanced mix of account types could have softened the blow. If I had built up a Roth IRA earlier—where qualified withdrawals are tax-free—I could have pulled from that source first, keeping my taxable income lower. Similarly, taxable brokerage accounts, while subject to capital gains taxes, offer more control over when and how much tax you pay. The lesson was clear: tax diversification is just as important as investment diversification. Understanding the tax treatment of each account type—taxable, tax-deferred, and tax-free—should be a cornerstone of retirement preparation. It’s not enough to save; you must also plan for how and when you’ll access those savings in the most tax-efficient way possible.

Why Tax Compliance Matters More Than You Think in Retirement

Many retirees assume that once they’re no longer earning a paycheck, their tax obligations will shrink. In reality, the opposite can happen. Without proper planning, retirement income from pensions, IRAs, 401(k)s, and even investment accounts can trigger higher tax bills and unexpected liabilities. Tax compliance in retirement isn’t just about filing on time—it’s about understanding the rules that govern your income sources and ensuring every withdrawal, benefit, and transaction aligns with IRS regulations. Failing to do so can lead to penalties, audits, and overpayment of taxes that could have been avoided.

One of the most common compliance pitfalls is miscalculating Required Minimum Distributions. The IRS mandates that individuals begin taking RMDs from traditional retirement accounts by April 1 following the year they turn 73 (as of 2023, under the SECURE Act 2.0). Forgetting or under-withdrawing can result in a penalty equal to 25% of the amount not taken—though this may be reduced to 10% if corrected promptly. I know someone who overlooked this rule during a busy year and ended up owing thousands in penalties. The calculation itself isn’t always straightforward, either. RMDs are based on life expectancy tables and your account balance from the prior year, meaning they change annually and require careful tracking.

Another area where retirees often stumble is Social Security taxation. While many view these benefits as tax-free, the truth is more nuanced. If your combined income—adjusted gross income plus nontaxable interest plus half of your Social Security benefits—exceeds certain thresholds, part of your benefits will be taxed. For individuals, that threshold starts at $25,000; for joint filers, it’s $32,000. Once you surpass $34,000 (or $44,000 for couples), up to 85% of benefits become taxable. This creates a hidden tax trap for those who don’t coordinate their income sources carefully.

Spousal coordination adds another layer of complexity. Couples must consider not only their own RMDs and benefit claiming strategies but also how one spouse’s income affects the other’s tax liability. For example, a high earner delaying Social Security while the lower earner claims early can optimize long-term benefits—but only if the tax implications are accounted for. Staying compliant means staying informed. It requires regular review of tax law changes, accurate recordkeeping, and often, consultation with a tax professional who understands retirement-specific issues. The goal isn’t to avoid taxes—you can’t—but to pay only what’s necessary and avoid costly mistakes that erode your savings.

Building a Tax-Aware Withdrawal Strategy: What I Wish I’d Known Sooner

One of the most powerful yet overlooked aspects of retirement planning is the order in which you withdraw funds from different accounts. Most people assume it’s best to tap retirement accounts first since they’ve been growing for decades. But doing so without strategy can lead to unnecessarily high taxes. I learned this through trial and error. Initially, I pulled from my traditional IRA to cover living expenses, thinking I was accessing my “own” money. Instead, I was inflating my taxable income and inviting higher tax bills. Over time, I refined my approach into what financial planners call a “withdrawal ladder”—a deliberate sequence designed to minimize taxes and extend the life of my portfolio.

My optimized strategy now follows a three-tiered order: first from taxable accounts, then from tax-deferred accounts like traditional IRAs, and finally from tax-free accounts such as Roth IRAs. Here’s why this works. Taxable brokerage accounts are subject to capital gains taxes, but only when you sell appreciated assets. By selectively selling holdings with low or no gains—or using losses to offset gains—I can often withdraw money with little to no tax impact. Additionally, long-term capital gains are taxed at lower rates than ordinary income, making this a more efficient source of funds in early retirement.

Next, I draw from tax-deferred accounts once I reach RMD age. By delaying withdrawals from these accounts as long as possible (while staying compliant), I allow the money to continue growing without immediate tax consequences. Pulling from them later, especially after depleting other sources, helps keep my income—and tax rate—lower in the early years of retirement. This is particularly important because Medicare premiums and Social Security taxation are both tied to your income from two years prior (known as Modified Adjusted Gross Income, or MAGI). Keeping MAGI low in your early 70s can prevent premium surcharges later.

The final rung of the ladder is the Roth IRA. Because qualified withdrawals are completely tax-free and not counted in RMD calculations (for the original account holder), I treat this as a longevity hedge. I preserve these funds for later in retirement or for unexpected expenses, knowing they won’t increase my taxable income. This tiered strategy has allowed me to maintain a stable standard of living while reducing my overall tax burden. It’s not a one-size-fits-all solution—your health, spending needs, and portfolio mix matter—but the principle remains: the sequence of withdrawals is a powerful tool for tax efficiency. By planning ahead, you can stretch your savings further and retain more of what you’ve worked so hard to build.

Using Tax-Loss Harvesting to Offset Gains Without Risking My Nest Egg

Market downturns are inevitable, but they don’t have to be destructive. In fact, I’ve learned to use them to my advantage through a strategy called tax-loss harvesting. This technique allows investors to sell underperforming assets at a loss and use that loss to offset capital gains elsewhere in their portfolio. If losses exceed gains, up to $3,000 can be used to reduce ordinary income annually, with any remaining losses carried forward to future years. The key is doing this without disrupting your long-term investment strategy or triggering IRS penalties.

I first applied tax-loss harvesting during the market correction of 2020. Like many investors, I saw the value of certain holdings dip. Instead of waiting passively, I reviewed my portfolio for positions that were down and no longer aligned with my goals. I sold a few equity funds that had declined, realizing a $12,000 loss. That year, I also had $5,000 in capital gains from selling another investment. By applying the loss, I eliminated the tax on those gains and used an additional $3,000 to reduce my taxable income. The remaining $4,000 rolled over to the next year, where it offset gains again. Over time, this approach has saved me hundreds, possibly thousands, in taxes.

One critical rule to observe is the IRS wash-sale provision. This rule disallows a loss deduction if you buy a “substantially identical” security within 30 days before or after the sale. To comply, I avoid repurchasing the exact same fund. Instead, I may invest in a similar but not identical asset—such as switching from one S&P 500 index fund to another with a different provider—or wait at least 31 days before reinvesting. This maintains my market exposure while preserving the tax benefit.

Tax-loss harvesting isn’t about market timing or speculation. It’s a disciplined, rules-based strategy that turns volatility into opportunity. It works best in taxable accounts, where capital gains and losses are realized, and it requires careful recordkeeping to track cost bases and transaction dates. When done correctly, it enhances after-tax returns without increasing risk. For retirees living off investment income, this can mean more money available for living expenses or reinvestment. It’s a subtle but powerful way to protect your nest egg—not by chasing returns, but by keeping more of what you’ve already earned.

Coordinating Social Security and Medicare With Tax Planning

Deciding when to claim Social Security is one of the most consequential financial choices in retirement. While many focus on maximizing lifetime benefits, fewer consider how the timing affects their tax bill. I spent months analyzing different claiming strategies, and what I discovered reshaped my entire early retirement plan. By delaying my benefits from age 67 to 70, I increased my monthly payment by 24% due to delayed retirement credits. More importantly, I kept my taxable income low during the first few years of retirement, which had ripple effects on other areas of my finances.

Because Social Security benefits are taxed based on your total income, claiming early can inadvertently push you into a higher tax bracket—especially if you’re also taking RMDs or have substantial investment income. By waiting, I was able to rely on my taxable and tax-deferred accounts during those years, strategically managing my withdrawals to stay below key tax thresholds. This not only reduced my federal tax liability but also helped me avoid higher Medicare premiums.

Medicare Part B and Part D premiums are determined by your income from two years earlier, using a measure called Income-Related Monthly Adjustment Amount (IRMAA). For 2024, individuals with MAGI above $103,000 (and couples above $206,000) pay surcharges that can add hundreds of dollars per month to their bills. These tiers go up significantly, with the highest earners paying over $500 extra monthly. Because I kept my income low in my early 70s by delaying Social Security and managing withdrawals, I remained below the IRMAA thresholds and saved thousands over several years.

The coordination between Social Security, Medicare, and tax planning is often overlooked, but it’s a prime example of how integrated financial decisions yield better outcomes. It’s not just about when you claim benefits, but how that decision interacts with your overall income picture. For married couples, the strategy becomes even more nuanced, involving spousal and survivor benefits. The goal is to create a sustainable income flow that minimizes taxes and maximizes purchasing power over time. This requires foresight, flexibility, and a willingness to look beyond short-term convenience for long-term gain.

Estate and Legacy Planning: Keeping Taxes Low for My Heirs

Retirement planning isn’t complete until you’ve considered what happens after you’re gone. I didn’t want my children to inherit a tax burden along with my assets. Unfortunately, the rules around inherited retirement accounts have changed, and many heirs are unprepared for the tax implications. Under the SECURE Act of 2019, most non-spouse beneficiaries must withdraw all funds from an inherited traditional IRA within 10 years. While this provides flexibility, it also creates potential tax spikes if large withdrawals are made in a single year. I wanted to prevent that.

To reduce the future tax load on my heirs, I began a series of Roth conversions. Each year, I convert a portion of my traditional IRA to a Roth IRA, paying the taxes upfront at my current (and relatively lower) tax rate. The converted amount then grows tax-free, and my heirs can withdraw it tax-free as well—though they must still follow the 10-year rule. This strategy, often called “stretching the tax hit,” allows me to control when and how much tax is paid, rather than leaving a large bill for my children to handle during an emotionally difficult time.

I also reviewed and updated all beneficiary designations. It’s surprising how often these forms are outdated—naming ex-spouses, deceased relatives, or not accounting for new grandchildren. I ensured that each retirement account, life insurance policy, and financial institution had current, clearly designated beneficiaries. I also established a revocable living trust to provide additional control over asset distribution and avoid probate, which can be time-consuming and costly.

Another key step was educating my family. I held a family meeting to explain my estate plan, the rationale behind my decisions, and where important documents are stored. This transparency reduces confusion and conflict later. Legacy planning isn’t just about wealth transfer—it’s about peace of mind for everyone involved. By taking proactive steps now, I’ve made it easier for my loved ones to focus on healing rather than paperwork. And by minimizing taxes, I’ve ensured that more of what I’ve saved goes to the people who matter most.

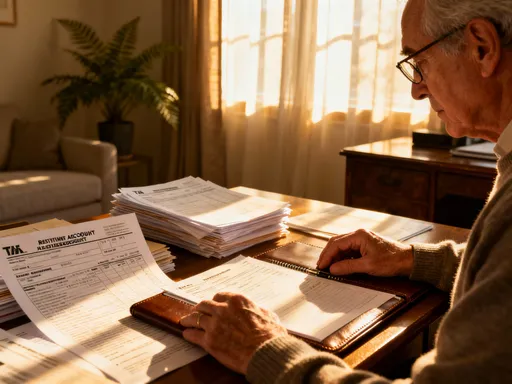

Staying Audit-Ready: Simple Habits That Keep Me Compliant

The idea of an IRS audit can be intimidating, but I’ve found that staying prepared eliminates most of the fear. I don’t aim for perfection—I aim for consistency and clarity. Over the years, I’ve developed a few simple habits that keep my records in order and my filings accurate. These practices take minimal time but provide significant protection. Being audit-ready isn’t about suspicion; it’s about responsibility and confidence in your financial life.

First, I maintain a dedicated digital folder for all tax-related documents. This includes year-end statements (1099s, W-2s), charitable contribution receipts, healthcare forms, and records of investment transactions. I organize them by year and label them clearly. I also keep scanned copies of signed tax returns and any correspondence with the IRS. Having everything in one place makes filing faster and reduces the risk of missing important information.

Second, I use tax software that integrates with my financial accounts. This allows me to import data directly, reducing manual entry errors. I review each imported item carefully to ensure accuracy—especially RMDs, Social Security income, and capital gains. I also reconcile my records with those provided by financial institutions annually. If there’s a discrepancy, I address it immediately rather than waiting until tax season.

Finally, I file my return early. This isn’t just about getting a refund sooner—it’s about avoiding last-minute rushes and catching errors before the deadline. Filing early also reduces the window for identity theft, as someone else can’t file a fraudulent return in your name once the IRS has accepted yours. I double-check every entry, use the same filing status and dependents consistently, and keep a checklist of common deductions and credits I qualify for.

These habits have given me a sense of control over my financial life. I no longer dread tax season. Instead, I see it as a routine check-up—a chance to review my progress, adjust my strategy, and ensure everything is on track. Compliance isn’t a burden when it’s built into your routine. It becomes a quiet assurance that you’re doing things the right way, protecting your savings, and honoring the effort you’ve put into building a secure retirement.